Intelligent investingWith a technological advantage

Our strategy finds and invests in wonderful growing companies selling for less than they are worth.

94.98% of these investments have been sold with a profit.

How we pick winning stocks

Meet Joe. Joe is an artificial intelligence with a diverse personality. He simultaneously thinks like 25 of the best super investors, such as Benjamin Graham, Philip Fisher, Warren Buffett, Jesse Livermore, to name a few.

Joe can help you earn a better return on your capital. He is happy when he can invest in a wonderful business with good growth prospects, a great business model, purchased at a price well below its intrinsic value.

Price is what you pay, value is what you get. Joe's task is to make sure you get your moneys worth of good businesses at a sharp price.

He is adept at avoiding mistakes, careful about evaluating finances, business models and management teams as well as 200 other factors influencing a positive outcome.

While you sleep, Joe tirelessly evaluates thousands of business opportunities selecting the very best, giving you more time to focus on what you love to do.

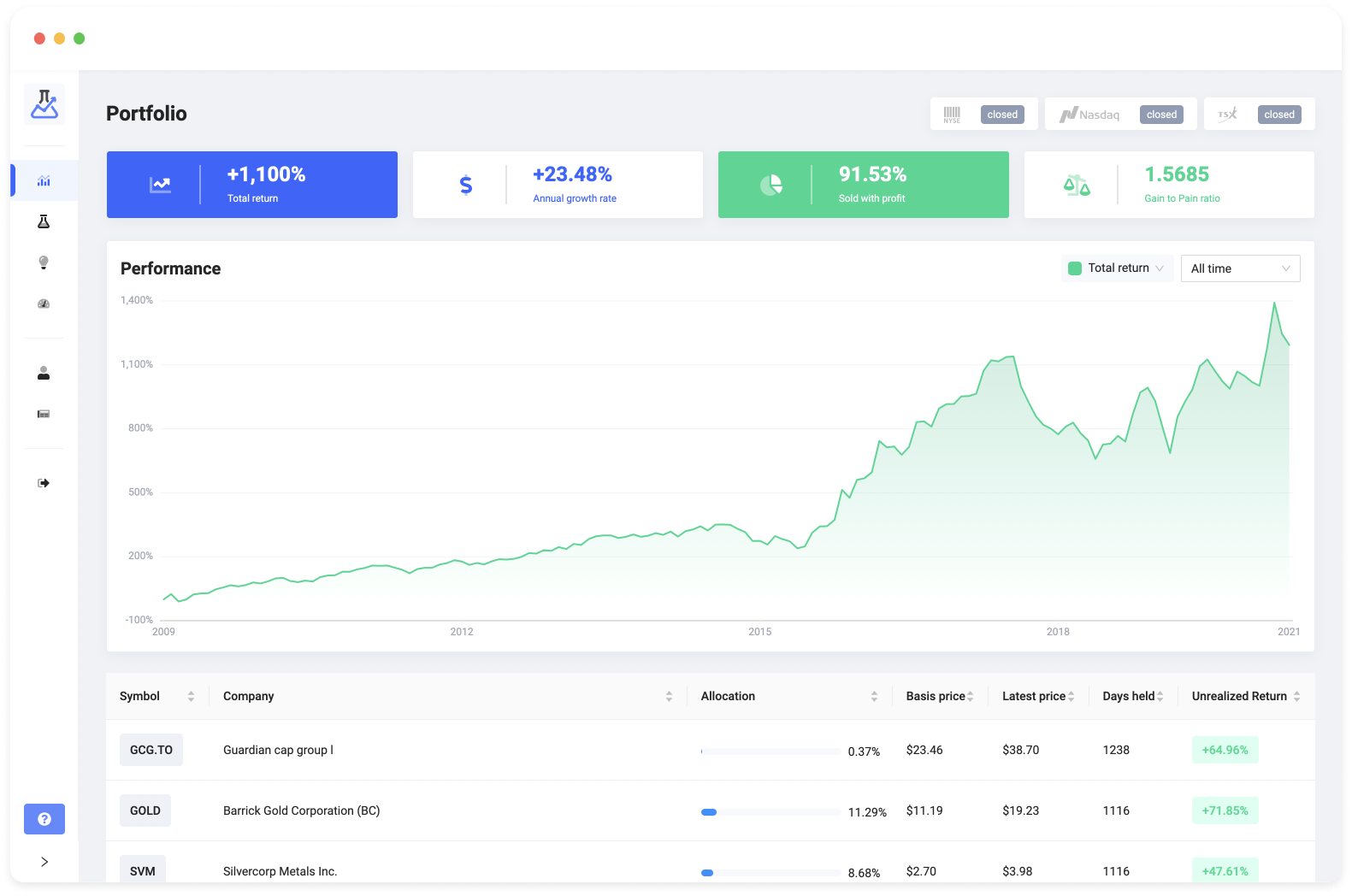

Performance

Log scale chart showing how $25,000 could have multiplied since 1970

Loading chart

*Historical numbers are based on backtested data. Since our 2009 launch we have observed similar results in real-time.

High returns, low risk

A hallmark of successful investing is achieving higher returns without equally higher risk.

Benjamin Graham pioneered the concept of a margin of safety, around which our technology is developed.

While risk can never be eliminated, we look for wonderful companies trading for considerably less than they are worth, thus minimizing the risks inherent in stock investing.

More upside. Less downside.

Latest sell signals

Here's our 10 latest sell signals (updated monthly)

| Trade | First bought on | Holding period | Avg. buy price | Sold at | Return |

|---|---|---|---|---|---|

Statistics & Ratios

Ratio of winners relative to losers.

94.98%Average return of the 94.98% winning investments

+74.99%Average loss of the 5.02% losing investments

-16.74%Average return per investment

+70.39%Average holding period

826 daysFollow our results over time!

Join our newsletter, to receive emails with actual results of our investment signals (good or bad).

The AI Score

There are multiple ways to invest intelligently. You have previously met Joe, who specializes in selecting individual winning stocks.

Another approach is quantitative investing, where you invest in a "basket" of stocks, say 40 stocks, which sports certain winning traits. These traits are derived from more than 200 quantitative and qualitative factors, computed for each stock. Called the AI-score, a number between -100 and 100, indicating attractiveness.

Consider a stock with -100 as something to avoid, and a stock with an AI-score of 100 as something to absolutely invest in. Since all supported stocks receive a score you can construct your own preferred portfolio or use it as a supporting investment tool. For each stock you also get access to a report, detailing risk vs. reward, value, growth, profitability, soundness and much more.

If invested in 40 stocks with an AI-score > 80 a typical historical avg. return would have been 27% pro anno*. See study for further details.*Past performance does not guarantee future performance

Pricing

Our products are fine-tuned for your portfolio size.

Verifiable results

Since inception in 2003, and launch in 2009, Formula Stocks has delivered strong results for its users.

Upon launch we initiated a 3 year pilot program, as verified by a 3rd party licensed auditor:

2009: +78.94%2010: +44.64%2011: +17.51%

Optimizing the odds for great future results is what Joe does best, even as future results are always unknown.

By clicking below you can examine how each of our previous trades have worked out seen in retrospect.

How to get started

Using Formula Stocks is easy and only requires a few minutes of trading each month.

Mirror portfolio

To get started simply mirror our portfolio in your brokerage account of choice. Our dashboard shows exactly how much to allocate to each stock.

Follow monthly trades

Every month, the system re-evaluates it’s portfolio, buying & selling stocks. You'll be notified of the new trades that you can make in your own account to follow along.